The price of a stock is $40. The price of a one-year European put option on the stock with a strike price of $30 is quoted as $7 and the price of

The price of a strike of a stock is $40/share. The price of a one-year European stock with price of $30 quoted as $7/share put option on the on the shorts with

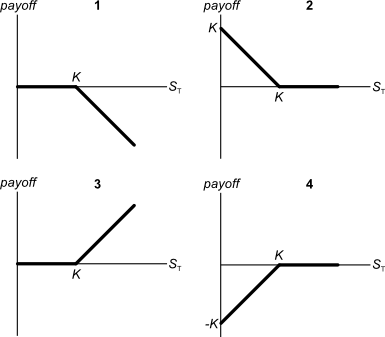

Mechanics of Option Markets CHAPTER 9. Types of Options Ability to Exercise According to Positions Derivative Instrument Basic Options Call Options European. - ppt download

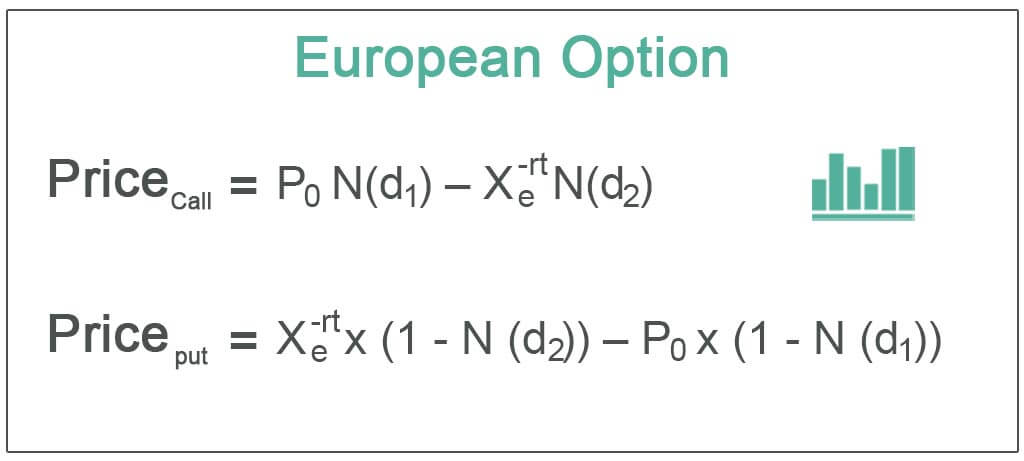

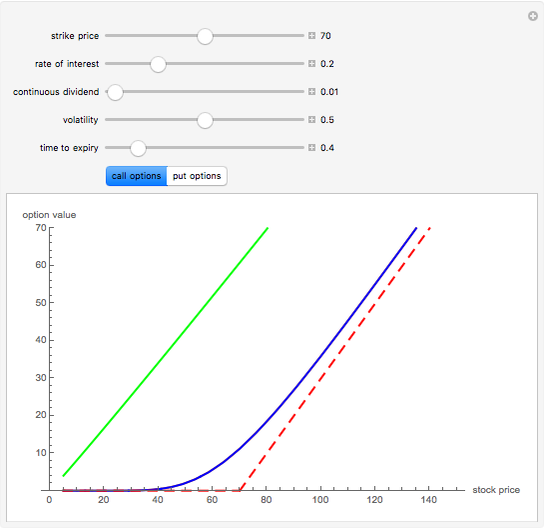

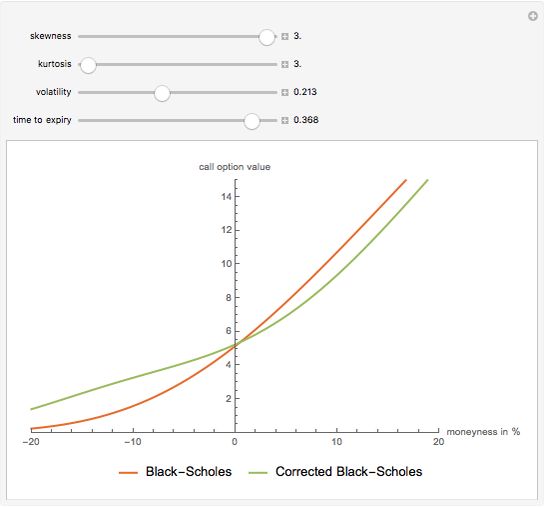

The Black-Scholes European Call Option Formula Corrected Using the Gram-Charlier Expansion - Wolfram Demonstrations Project

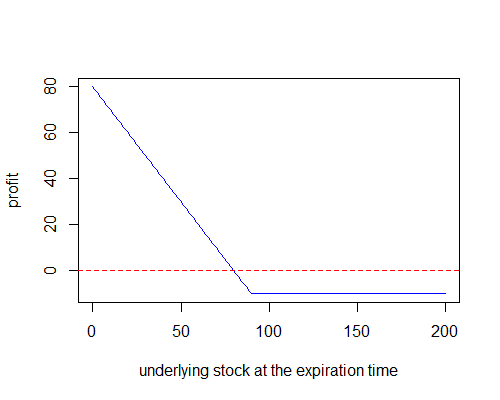

Problem 9.9 Suppose that a European call option to buy a share for $100.00 costs $5.00 and is held until maturity. Under what ci

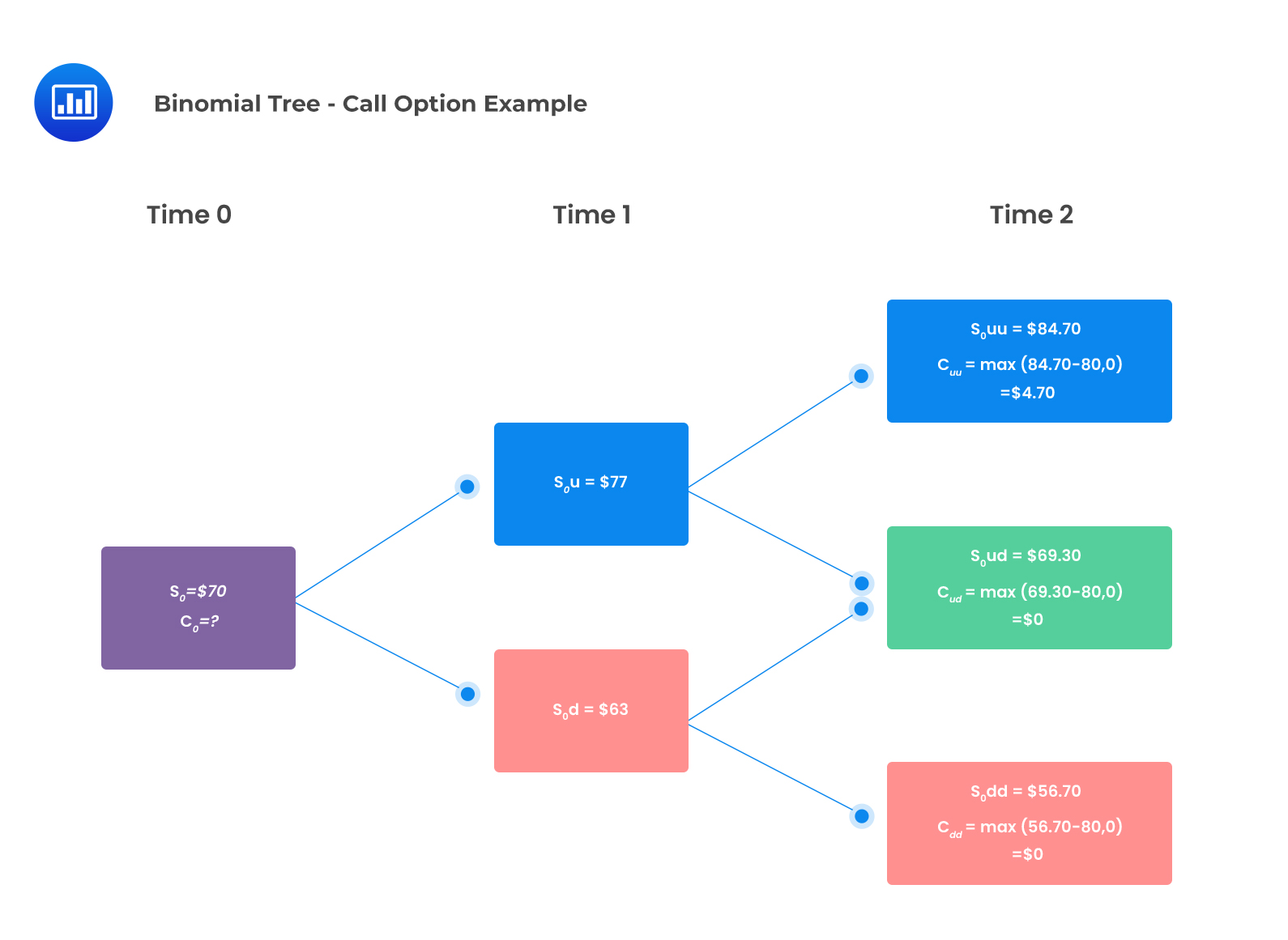

![PDF] NON-UNIFORM FINITE DIFFERENCE METHOD FOR EUROPEAN AND AMERICAN PUT OPTION USING BLACK-SCHOLES MODEL | Semantic Scholar PDF] NON-UNIFORM FINITE DIFFERENCE METHOD FOR EUROPEAN AND AMERICAN PUT OPTION USING BLACK-SCHOLES MODEL | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/e4a1d5afb4ae54a17cea0cd64aceda55e382836e/9-Figure2-1.png)