TI BA II+: How to compute bond price on realistic (between coupons) settlement date (TIBA2-02) - YouTube

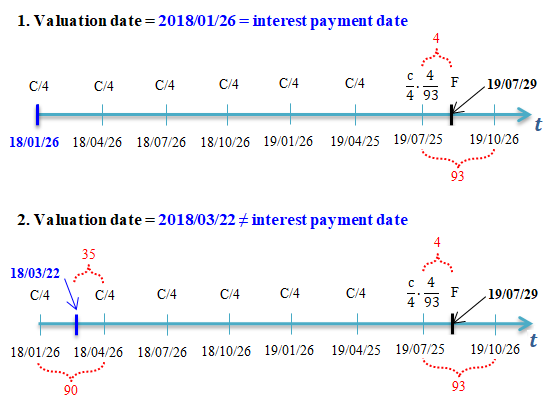

Actuarial Exam 2/FM Prep: Bond Price Between Coupon Payments (with Semi-Theoretical Method) - YouTube

Bond Pricing Between Coupon Dates (Solved Example)(CFA Level 1, FRM Part 1 Valuation & Risk Models) - YouTube

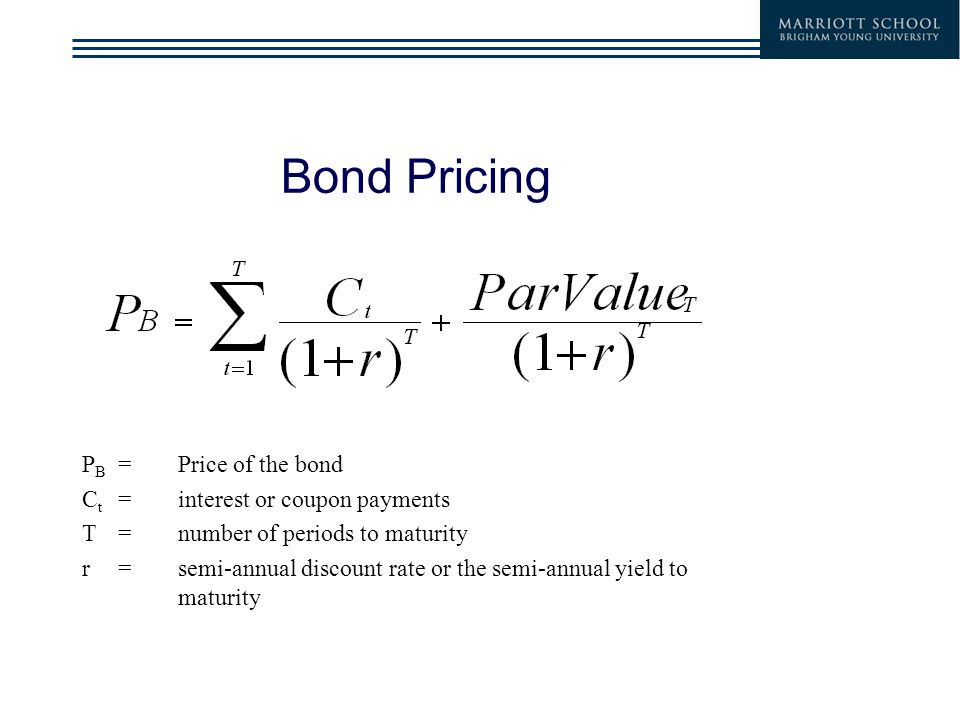

Bond Pricing P B =Price of the bond C t = interest or coupon payments T= number of periods to maturity r= semi-annual discount rate or the semi-annual. - ppt download

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)